b4517e No.120564 [View All]

31JAN22 to 25JAN23

/qresearch/ South Africa

Re-Posts of notables

Contained threads:

292148ZJAN22 >>>/qresearch/15493933 Q Research South Africa #7: "TRUTH cannot be hidden forever" Edition

https://9ch.net/qresearch/res/15493933.html

062047ZJUL22 >>>/qresearch/16650233 Q Research South Africa #8: We Dig More On Glencore Edition

https://9ch.net/qresearch/res/16650233.html

090159ZJUL22 >>>/qresearch/16693989 Q Research South Africa #9: Springbok Strong Edition

https://9ch.net/qresearch/res/16693989.html

240343ZOCT22 >>>/qresearch/17705335 Q Research South Africa #10: Restart Edition

https://9ch.net/qresearch/res/17705335.html

____________________________

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

Post last edited at

b4517e No.127666

Originally posted at >>>/qresearch/18103969 (081639ZJAN23) Notable: Final Commodities Bun / David v Goliath court battle on the cards between coal mines (Parts 1&2)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>127665

“David v Goliath court battle on the cards between coal mines” – Part 2

https://www.iol.co.za/sundayindependent/news/david-v-goliath-court-battle-on-the-cards-between-coal-mines-2cac2bf7-4f3d-4277-a957-295de5099584

SUNDAY, JANUARY 8, 2023

RBCT CEO Allan Waller stated in the December 20 letter that given the additional information that OCT had provided, the RBCT board would consider it and provide feedback by January 20 on whether the earlier deadline to block OCT from using the facility still stands. On November 30 last year, RBCT had given OCT until January 31 to cease exporting coal through the terminal.

“In the circumstances, RBCT is not currently in a position to consider agreeing to any further extensions to OCT beyond 31 January 2023, which (was the) extended date you had proposed in October 2022 and confirms that its position set out in its letter to you of, November 30, 2022, stands. We understand that OCT must consider taking whatever lawful steps it deems appropriate and are open to it in the circumstances,” Waller said.

The withdrawal of OCT’s access to the coal terminal would place at risk the jobs of up to 2 000 workers employed by the group of contractors currently conducting limited operations on “mini-pits” as part of the business rescue plan.

The OCT business rescue practitioners, Kurt Knoop and Kgashane Monyela, said in a response to RBCT, dated December 26, that “in the event that RBCT’s position remains unchanged from the one set out in your letter of November 30, 2022, notwithstanding its consideration of the information and submissions made by us subsequent thereto, it will leave the parties with a mere seven working days to finalise an urgent court application that will by necessity have to deal with substantial and possibly complex issues of fact and law”.

“This includes having to finalise the drafting of the application after considering RBCT’s communication of January 20, 2023, serving the application, providing RBCT time to answer thereto, replying to the answering affidavit, dealing with intervention applications that will no doubt be brought, preparing for an argument, allowing the court time to hear the application, consider it and write a judgment on it, all within the space of less than two weeks.”

Knoop and Monyela said that “it will not only be impractical to attempt the above in the time frame imposed by RBCT but may also cause severe prejudice to all parties involved, as well as the court, to attempt to do so”.

“Conversely, should the parties agree to truncated but practical time frames within which to achieve the finalisation of an urgent application, it will not cause any prejudice to any of the parties,” they continued.

OCT intended to launch its urgent application by January 25, then receive answering affidavits from RBCT by February 3 and provide replies five days later. It was expected that the court application would be heard on February 13.

“We submit that the above proposal not only provides for a practical way to deal with the possible urgent legal proceedings that may follow the January 20, 2023 communication but will also curtail the substantial prejudice that will be suffered by the parties and the court if the very unpractical alternative set out above is imposed,” OCT said.

OCT had given RBCT a deadline of Friday to confirm the proposed schedule, however there was no response at the time of going to print.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127667

Originally posted at >>>/qresearch/18109424 (091422ZJAN23) Notable: Eskom and Water Crisis Bun Part One / Eskom loses billions on coal contracts

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>127665

>Glencore, in which President Cyril Ramaphosa previously served as chairperson

>Ramaphosa was in partnership with Glencore while a director of Shanduka Group, a diversified industrial company with significant coal mining interests including a stake in OCM – later sold to Gupta-owned Tegeta Resources in 2016.

“Eskom loses billions on coal contracts”

https://mg.co.za/article/2019-04-05-00-eskom-loses-billions-on-coal-contracts/

5 Apr 2019

Broke state power utility Eskom is losing billions of rands by paying different prices to suppliers for the same quality coal.

The result of this is a loss of R1.4-billion, at worst, on two contracts alone. Eskom is paying one supplier, Glencore, double the price it is paying another, smaller supplier for the same quality coal.

An analysis of a spreadsheet of some of Eskom’s short- and mid-term contracts entered into last year, and seen by the Mail & Guardian,show a R343.41 difference between Glencore’s R607.01/tonne price for coal (with a calorific value of 20.5) and the cheapest supplier of the same quality coal, Stuart’s Coal, which is priced at R263.63/tonne.

The analysis also revealed Eskom has been paying five different prices to five different companies, including Glencore and Stuart’s Coal, for the same quality coal.

In another example, Eskom contracted Glencore to deliver 21.50CV coal to Kriel power station at R665.85/tonne, but it also contracted Welgemeend Colliery to deliver the same quality coal to Matla power station at R342.28/tonne. The saving on this transaction, had Eskom paid the same, would have been R291-million.

It is critical to note that the prices listed here do not include transportation costs, which, depending on mode of transport and distance between the mine and the power station, could easily add a further R90-R300 per tonne.

“The high price of coal connections”

https://mg.co.za/article/2019-10-11-00-the-high-price-of-coal-connections/

11 Oct 2019

The taxpayer will be burdened with a roughly R10-billion bill over the next six years, because Eskom has failed to negotiate a standard price for the coal it burns to keep the lights on.

The Mail & Guardian can reveal that Eskom has contracted 16 coal-producing companies to provide it with more than 70-million tonnes of coal in the next six years at a cost of more than R38-billion.

But Eskom could have saved about R10-billion — or nearly R4.5-million a day — had it negotiated a better deal.

Responding to M&G questions, Eskom said it was untrue that it has failed to negotiate coal prices but rather it ended up paying higher prices due to a rapid decline of coal stock. [BS! Creating a demand as there are 1 000s of hectares of land in the Lephale area with shallow coal which can be mined. Now the Russia/Ukraine conflict has increased prices global. All orchestrated as crisis are good for big business.]

One former Eskom executive asked: “Why was it wrong when the Guptas were being paid more and it is now okay when it is companies such as Glencore and Seriti?” adding that if there was no reason to pay such high prices then, why now?

A senior Eskom official, who did not want to be named, told the M&G that the prices varied from one mine to another: “Prices from old contracts were cheaper … emergencies created from 2008 and future years pushed prices up. Transport prices are currently inflated to benefit suppliers with connected officials. Some prices are inflated — claiming good quality coal, which is not true.”

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127668

Originally posted at >>>/qresearch/18109453 (091429ZJAN23) Notable: Eskom and Water Crisis Bun Part One / Eskom officials, police involved in syndicate stealing millions worth of fuel from Kriel Power Station

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>127664

>Investigations are also ongoing into Eskom being billed for thousands of litres of fuel oil that never gets delivered to its power plants.

“Eskom officials, police involved in syndicate stealing millions worth of fuel from Kriel Power Station – report”

https://www.citizen.co.za/news/south-africa/eskom-fuel-kriel-may-2022/

16 May 2022

Eskom CEO André de Ruyter says the theft of fuel at Kriel Power Station is disrupting their operations

A sophisticated criminal syndicate has reportedly been stealing millions of rand worth of fuel at Eskom’s Kriel Power Station in Mpumalanga.

Investigative journalism unit, amaBhungane, on Monday, reported that the syndicate worked in cahoots with Eskom officials, police and trucking companies to steal fuel from the coal-powered station.

The syndicate has reportedly been exploiting a design flaw at the station that has to do with a weigh bridge.

Eskom’s Kriel Power Station uses fuel-oil at start-up or during unstable furnace conditions to ignite or stabilise the coal flame. The fuel-oil is reportedly stored in four storage tanks with a combined capacity of 1,350 tons.

A truck driver who spoke to amaBhungane, on condition of anonymity, said unlike other power stations owned by Eskom, the weigh bridge at Kriel was outside the power station and not inside the Eskom yard.

“This gives a chance for trucks to drive to other locations to offload and then come back to weigh,” the truck driver was quoted as saying.

Among the reasons behind the theft of fuel at Kriel were reportedly lax security and officials not playing an oversight role to determine the amount of fuel being ordered.

Three drivers amaBhungane spoke to claimed that a full tanker was usually worth between R500,000 and R1 million, depending on the size of a tanker and the type of fuel.

On the black market, the minimum price for the load would be R250,000.

Cash deposit payments

Sources claimed that Eskom and police officials involved in the syndicate received and made payments via cash deposits at automatic teller machines, which made them difficult to trace.

A truck driver was arrested outside Kriel Power Station on 18 March after he was allegedly caught with a tanker full of stolen fuel.

Douglas Ndivhatzo Ralulimi, 39, is reportedly out on bail of R10,000.

The theft case was taken over by the Directorate for Priority Crime Investigation, also known as the Hawks.

The Hawks declined to comment when approached for comment by amaBhungane, arguing that the investigation was still active.

Eskom CEO André de Ruyter acknowledged the amaBhungane story during a media briefing on Monday on load shedding.

Without elaborating on the matter, De Ruyter said the theft of fuel by criminal syndicates at Kriel was disrupting their operations.

“That plant currently has two units completely out and partial load losses of 300MW. So that’s another 900MW of capacity we do not have available,” he said.

The Citizen has reached out to Eskom for comment. The story will be updated once comment is received.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127669

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18109459 (091430ZJAN23) Notable: Eskom and Water Crisis Bun Part One / Global energy restructuring veteran KW Miller says nothing comes even close to the Eskom disaster (video)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>>/qresearch/17910156

>>>>/qresearch/17774332 Global energy restructuring veteran KW Miller says nothing comes even close to the Eskom disaster (video)

“Global energy restructuring veteran KW Miller says nothing comes even close to the Eskom disaster”

https://youtu.be/be4vChJ3E1s

Oct 31, 2022

Now that the ANC government has finally admitted defeat on Eskom by ending its monopoly and last week promising to assume up to ⅔ of its massive debt burden, the facade is being stripped from SA's teetering electricity provider. Global energy turnaround specialist KW Miller, who calls Eskom an "operationally dysfunctional, financially insolvent, unreliable and corrupt entity" says the path forward will be determined by the actions of creditors which own a large chunk of mostly SA government-guaranteed Eskom debt that he says is far higher than the official number of R400bn. Eskom has tapped global bond markets for decades - and according to Miller those who own the debt are now insisting the disaster be urgently addressed. In this powerful interview with Alec Hogg of BizNews.com, media-shy Miller says the only route now open for SA's State-owned electricity provider is for the private sector to take over the productive assets to cut off third-party leeches and criminal syndicates that continue to bleed the utility. Abu Dhabi-based Miller, who rarely grants interviews, says he "made an exception given the importance of the Eskom restructuring to SA citizens."

22:08 – “Many years ago, must be 12 years ago. Howard Buffet, Warren Buffet’s son and very involved in Berkshire Hathaway and Berkshire Hathaway Energy in the United States who had at that stage a farm in South Africa, offered to get involved with Eskom. He even sent over into action with some of the guys at Eskom, I helped them because I knew both sides to put them together and it seemed imminently sensible but nothing came of it because Eskom refused to take outside help.”

25:45 – “By the way for your viewers, I’m going to give you a heads up now. The South African water system is on the verge of collapse up in the Gauteng area. It’s a mess. I think you’re going to see the next crisis in South Africa will be water but we’ll get to that. But water we focus on because it’s needed for power plants. So with that said you come to a point where you can only cannibalize your economy so much. There’s really nothing else to cannibalize. Everything has been stole, Alec.”

26:18 – “The only thing keeping the criminal syndicates alive in South Africa. You want to know the truth? The coal contracts that they skim off of, the diesel contracts, the renewable contracts. All that money gets skimmed off by various actors in South Africa and it completely wrecks the Energy System there. These are the facts that have been going on for many many years and it’s all come home to roost.”

29:54 – “Forensic audit is required. Now I will tell you for a fact that the current government will never allow a forensic audit of Eskom because they will go to jail. Okay, I could swear out affidavits in the Hague and put about 10 to 15 of the senior ANC officials in jail today. If the creditors wanted to do it, meaning we could basically take them into international courts for all the things they’ve done with the creditors’ money. You follow me. That’s international investors but what good is that, they’ve already got billions parked offshore in Mauritius and other places.”

31:18 – “We put out 2 notices, I’m gonna leave this with you because I think everybody needs to understand. One is we declared a state of emergency in the South African energy market. We did that last week. Okay, you’ll hear more about it. Number 2, we’ve declared Eskom the biggest energy industrial Ponzi scheme in global history. The numbers are off the charts. Eskom is a massive Ponzi scheme when you look at how it’s basically been completely undone from within over the years and all of the corruption and fraud that’s ongoing in the contracts today. Even while the wheels are falling off…It’s astounding! It’s something that most people can’t even comprehend.”

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127670

Originally posted at >>>/qresearch/18109501 (091440ZJAN23) Notable: Final Commodities Bun / Charges against Denel executive may backfire (Parts 1&2)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>127644

>The document implicates... Pravin Gordhan

>>127655

>PRAVIN GORDHAN IS AN OLD FRIEND OF WHITE MONOPOLY CAPITAL

>>127651

>https://uncensoredopinion.co.za/pravins-portfolio-shares-reveals-much-state-capture/

“Charges against Denel executive may backfire” – Part 1

https://www.iol.co.za/sundayindependent/news/charges-against-denel-executive-may-backfire-15b090ab-b2a1-4674-abf2-813d4dfbd7b3

SUNDAY, JANUARY 8, 2023

Johannesburg - The disciplinary case of suspended Denel Dynamics CEO Sello Ntsihlele is set to blow the lid on secret deals to sell the state arms manufacturer's assets to politically connected cronies in bits and pieces to dodge intense public scrutiny.

The bulk of the 18 charges served last month on Ntsihlele relates to his refusal to implement “illegal instructions" to enable the alleged crooked sale of valuable assets, including intellectual property, at a dime.

And for his efforts to block taxpayers' money from subsidising cronies of powerful figures with an interest in the sale of public assets under a blanket restructuring plan that lacked detail, and research and was yet to be approved, Denel seeks to dismiss Ntsihlele if he is found guilty.

A prime example is the charge relating to Denel's attempt to sell three properties at its Irene campus for an amount of R189 million. However, at least one of the three properties was valued at R600m.

An insider asked: "It would cost roughly R1.5 billion to build these three properties from scratch, so why would Denel sell these assets for such a cheap amount? Who stands to benefit from this transaction if the public loses so much?"

Among the charges that betray Denel’s witch-hunt is the allegation that Ntsihlele leaked information to the Sunday Independent about an article last November. The story exposed Public Enterprises Minister Pravin Gordhan's intimidation tactics against Ntsihlele on at least two occasions.

Ntsihlele filed four employee grievances last August, including one against Gordhan – who had attacked him verbally – but the company failed to address his concerns. Instead, some of the senior executives who have pressed charges against Ntsihlele are among the people he had lodged grievances against.

According to the charge sheet, Ntsihlele is accused of gross insubordination relating to an incident where his juniors refused a rushed instruction to transfer "valuable" intellectual property on unmanned aerial vehicle designs to a phantom unit when the restructuring plan was still in the consultation phase with unions and employees.

Having failed to persuade the junior staff, Denel executives turned to Ntsihlele and instructed him to instruct his juniors to comply. But he declined for the same reasons that his subordinates had put forth.

"Their argument was that Denel's group CEO, Michael Kgobe, had sufficient executive powers to override all of them and approve the same instruction if he believed he would have been acting within the bounds of the law.“

In the second related gross insubordination charge, Ntsihlele is accused of refusing to “execute an executive management and board decision relating to the implementation of the restructuring process concerning the relocation of Unmanned Aerial Vehicles (UAVs)“, including transferring the intellectual property to a unit called "Air Capability Division," which was only an idea on paper as part of the restructuring plan and awaiting regulatory approval.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127671

Originally posted at >>>/qresearch/18109506 (091441ZJAN23) Notable: Final Commodities Bun / Charges against Denel executive may backfire (Parts 1&2)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>127670

“Charges against Denel executive may backfire” – Part 2

https://www.iol.co.za/sundayindependent/news/charges-against-denel-executive-may-backfire-15b090ab-b2a1-4674-abf2-813d4dfbd7b3

SUNDAY, JANUARY 8, 2023

In another incident, reflected in the charge sheet, Denel created work streams in a bid to bypass Ntsihlele's authority and gain access to information that he and others were protecting. When the scheme failed, the senior Denel executive came back to Ntsihlele and instructed him to enable the approval of the process by giving these work streams access to Denel Dynamics ICT resources.

He refused because it was not his task since he was not part of the work streams, said an insider. Also, said the person, "there was an impact study outstanding, which was expected to provide a scientific assessment of whether the move would benefit Denel or not”.

The Sunday Independent learnt that the work streams incident was at the centre of Ntsihlele’s grievance against the executives from the group.

Other charges include:

FAILURE TO ACT IN THE BEST INTEREST OF THE EMPLOYER: Ntsihlele is accused of failing and/ or neglecting to intervene in the disconnection of the Integrated Systems Solutions from the Denel Dynamics ICT system, during December 2021 allegedly by one of his subordinates, known to the publication, who has since left the company.

DISHONESTY: It is alleged that in an act of dishonesty, he claimed ignorance of Denel Dynamics’ decision to terminate one of the subunits' access to ICT services despite having been copied in the email communication regarding the disconnection. It is not clear why this is apportioned to Ntsihlele or his business unit as it would appear that other executives were copied in the said email.

GROSS MISCONDUCT: Ntsihlele is charged for promoting one of his subordinates against a directive from Group HR who apparently passed away sometime in July 2022.

DERELICTION OF DUTY: It is alleged that he signed a teaming agreement with a company co-owned by a former Denel executive who was dismissed by Denel as its Group CFO and financial director.

Kgobe said in the letter accompanying the charge sheet that Ntsihlele “failed to exercise a duty of good faith towards Denel, acted in a matter that infringes upon the trust relationship, and failed to comply with the express, implied and tacit terms of your employment contract, by making yourself guilty of gross misconduct”.

“In light of the aforementioned, you are required to attend a disciplinary hearing. The disciplinary hearing will take place on a date, time and venue to be communicated to you in due course,” Kgobe wrote in a letter dated December 12, last year.

Not leaving anything to chance, Denel has enlisted the services of an upmarket Sandton law firm Clive Dekker Hofmeyr to prosecute Ntsihlele.

“You are invited to obtain legal representation at your own cost. Denel will appoint an independent person to chair the hearing, whose details will also be communicated to you in due course", added Kgobe.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127672

Originally posted at >>>/qresearch/18110169 (091644ZJAN23) Notable: Final Violence and Crime Bun / 10111 crisis: More than seven million calls dropped at severely understaffed call centres

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“10111 crisis: More than seven million calls dropped at severely understaffed call centres”

https://www.thesouthafrican.com/news/10111-call-centres-police-understaffed-seven-million-calls-dropped-9-january-breaking/

09-01-2023 16:57

More than seven million calls to 10111 emergency centres have been dropped over the last three financial years in six provinces.

Police minister Bheki Cele revealed that South Africa’s 10111 emergency call centres are severely understaffed in a reply to a parliamentary question posed to him at the end of 2022.

10111 CALL CENTRES ARE SEVERELY UNDERSTAFFED

The Democratic Alliance’s (DA) Shadow Minister of Police, Andrew Whitfield, asked Cele what the ideal number of personnel employed at the police call centres should be in each province and the number of calls dropped across the country.

Whitfield limited the scope of his questions to the 2020-2021 and 20221-2022 financial years and the period since 1 April 2022.

“During this period only 4 061 of the ideal number of 10 032 staff members were employed at 10111 centres across South Africa’s nine provinces. This represents just 40.48% of the required staff,” said Whitfield.

Approximately seven million calls from possible victims of crime have been dropped during the specified period. However, the DA MP cautions that the figure does [not] provide a full picture of the situation as the Free State, Limpopo and Northern Cape were unable to provide feedback for the time period. A number of call centres have outdated software, which needs to be upgraded.

There’s also been a decline in the number of staff members deployed at the 10111 call centres year-on-year.

“In 2020/21 only 41.63% of the available posts were filled, followed by 41,5% in 2021/22 and 39.33% since 1 April 2022,” said Whitfield.

The available dropped call statistics over the past three financial years are as follows (A copy of the table provided in Cele’s answer will be attached below the list):

•	Eastern Cape: 271 746

•	Gauteng: 3.83 million

•	KwaZulu-Natal: 632 642

•	Mpumalanga: 1.44 million

•	North West: 30 181

•	Western Cape: 895 280

The DA MP said he intends to write to the Chairperson of the Portfolio Committee on Police to ask that the National Police Commissioner, General Fannie Masemola, prepares a “comprehensive turnaround plan” for 10111 centres across the country within 30 days.

“The 10111 number is the only line of defence some of our people have as they struggle against the unrelenting tide of crime sweeping across South Africa.

“We cannot allow South Africans to be abandoned and become even more defenceless due to the inability of the police to respond to emergencies,” said Whitfield.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127673

Originally posted at >>>/qresearch/18116174 (101405ZJAN23) Notable: Final Violence and Crime Bun / Police captain accuses Bok scrum-half Faf de Klerk of ‘attempted murder’

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

A good example of South African ‘policing’

“Police captain accuses Bok scrum-half Faf de Klerk of ‘attempted murder’”

https://www.iol.co.za/weekend-argus/news/police-captain-accuses-bok-scrum-half-faf-de-klerk-of-attempted-murder-47d0b09f-5a97-4816-a194-dd9637ecc671

MONDAY, JANUARY 9, 2023

Cape Town - Springbok Rugby World Cup-star Francois “Faf” de Klerk has been accused of threatening to use a panga to hack a Stellenbosch police captain to death and for hurling racial slurs.

This is despite the player claiming to have been more than 14 000km away at the time of the alleged incident, which is said to have occurred on December 8 at around 1pm in Stellenbosch.

De Klerk has vehemently denied the claims made by police captain Lesley Smith and maintains that he was in Japan at the time of the so-called “life-threatening” brawl.

But Smith stands by his allegation and claimed that it's not a case of “mistaken identity” and that he slapped the “Springbok scrum-half” with charges, as he “clearly” saw De Klerk drive off in a ramshackle Toyota Corolla, while he allegedly called him a “h***” minutes after he “tried to kill me with a panga”.

Smith also alleged that De Klerk told him “I will f*** kill you”.

De Klerk, 31, who captured hearts for his shoulder-length blonde hair, through his agent, rebutted the claims, stating that he does not even drive a Toyota Corolla.

“Faf has never driven a Toyota Corolla in his life,” maintained his agent Lean Schwartz, adding De Klerk has been out of the country for two months now.

“He left the country with the Springboks for their end of year tour to Europe, where after he left London for Tokyo, Japan to join his new club, Yokohama Cannon Eagles,” he said.

Footage of De Klerk with fellow club members during practice sessions in Tokyo is all over the internet, with date stamps ranging from the end of November up until early this month.

Schwartz said that “30 minutes” after finding out he was accused of trying to murder a police man, De Klerk submitted evidence to prove that the allegations were untrue, including copies of his passport and visa to the police investigating officer.

Weekend Argus obtained copies thereof, including De Klerk’s full itinerary. The itinerary shows De Klerk left London on November 27 just before 2pm for Dubai. After seven hours he landed at 12.40am on Monday, November 28.

Two hours later at 2.55am, De Klerk left Dubai International Airport for Tokyo, Japan. He arrived at 5.20pm the same day. The stamps in his visa correlates with the flight details.

De Klerk hasn’t left Japan since. The metadata of a picture De Klerk took of his visa also showed that it was taken on December 8 in Inagi, Wakabadai, the date Smith claimed he was almost murdered.

Despite this evidence, Smith said he had not withdrawn the attempted murder charges against De Klerk.

Director of SA Rugby and former Springbok coach, Rassie Erasmus told Weekend Argus it was not uncommon for such allegations to surface.

“I can tell you we receive various allegations (and) stories that we don’t really react anymore, seeing that the players’ personal life is their own,” he said.

The national rugby team is no stranger to controversy when it comes to the players and their personal scandals.

Former Springbok, Derick Hougaard also made headlines last year after a set of twins accused him of “hiring” the duo for sex.

However, the sisters later admitted that it was a hoax as they were allegedly hired by a third party “to spread the lies”.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127674

Originally posted at >>>/qresearch/18116201 (101416ZJAN23) Notable: Eskom and Water Crisis Bun Part One / DA says it’s irrational and disastrous to move Eskom to Energy Department

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>127472

>Mantashe says load-shedding worse than state capture

>>127555

>Sisulu said a decision cooked outside ANC processes saw Mantashe tell MPs to toe the party line.

>>127556 - Bidvest

>“Calls for Gwede Mantashe ‘to be fired’, amid money laundering allegations”

>>127557

>>127571 - Gwede in the ANC top 7

>>127644 - Bidvest

“DA says it’s irrational and disastrous to move Eskom to Energy Department”

https://www.iol.co.za/mercury/news/da-says-its-irrational-and-disastrous-to-move-eskom-to-energy-department-0f763b7f-ea0c-47d6-a349-d2872c93bd81

TUESDAY, JANUARY 10, 2023

The DA’s Ghaleb Cachalia has described a proposal by President Cyril Ramaphosa to move Eskom from the Department of Public Enterprises to the Ministry of Energy as irrational and disastrous.

The ANC adopted a resolution at its national elective conference last week which specified that state-owned companies operating in specific economic sectors, should be overseen by the relevant government departments.

Eskom is mired in a national energy crisis that has seen the state-owned entity become the greatest inhibitor to economic growth and job creation and constant bail outs have seen it draining the national fiscus.

The country experienced 205 days of rolling blackouts last year.

Cachalia said the country’s official opposition party was against the move and would fight it.

“We share the opinion of Professor Anton Eberhard who has warned that it would be a grave mistake to move Eskom to the Department of Mineral Resources and Energy (DMRE) or even a separate energy ministry.

“According to Eberhard, there is an obvious conflict of interest in an energy ministry being Eskom’s shareholder while also having responsibility for competition and regulation in the sector,” Cachalia said.

The DA says if the move takes place, Eskom will never be fully unbundled and will retain its dominant market position “and the envisaged open power exchange and market will not, in all probability be implemented”.

“Private investment will be pushed to the back burner and under an enhanced version of the status quo – back to the future, as it were – corruption and load shedding will flourish again. The move also has potentially significant financial implications which we are busy unravelling.

“The only faction set to gain from this move clearly an outcome of a political deal to keep president Ramaphosa in power for another term,” Cachalia said in a statement.

Eskom CEO Andre de Ruyter announced his resignation from the power utility late last year but will remain in the position until March until a new CEO is appointed.

Cachalia said in the run-up to De Ruyter’s resignation, Energy Minister Gwede Mantashe’s “destructive influence was on full display, accusing De Ruyter of a raft of unsubstantiated and unconscionable actions”.

“He is on record as saying ‘Eskom, by not attending to load-shedding, is agitating for the overthrow of the state’. This, on top of earlier statements that De Ruyter was acting ‘like a policeman’ at the corruption-riddled entity.

“It would therefore be a grave mistake to move the utility.”

Cachalia said while it is possible to fix Eskom it is necessary to explore and accelerate generation from other multiple sources on a source agnostic/lowest cost basis “while we explore the most suitable, least invasive, energy-dense solution – let alone opening up the sector to private investment”.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127675

Originally posted at >>>/qresearch/18148888 (151546ZJAN23) Notable: Final Phala Phala & Ramophosa Bun / Zuma v Ramaphosa: NGO wants to join case as friend of court, targets NPA for alleged bias

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“Zuma v Ramaphosa: NGO wants to join case as friend of court, targets NPA for alleged bias”

https://www.iol.co.za/news/zuma-v-ramaphosa-ngo-wants-to-join-case-as-friend-of-court-targets-npa-for-alleged-bias-21b1a3a5-8855-40ff-9f66-17cdbd3aa421

WEDNESDAY, JANUARY 11, 2023

Durban - A non-governmental organisation (NGO) calling itself Blackhouse Kollective Foundation (BHK) wants to be allowed to join Thursday’s legal battle between former president Jacob Zuma and President Cyril Ramaphosa as a friend of the court (amicus curiae).

The NGO says it wrote to both warring parties asking if they have any qualms with it joining the battle and only Zuma’s legal team responded, expressing no objection, while Ramaphosa’s team never responded.

In the main, the little-known NGO seeks clarity regarding the role of the NPA (National Prosecuting Authority) and the powers it has in issuing nolle prosequi (non-prosecution certificates) before any private prosecution could take place.

The NGO’s affidavit setting outs its application was done under oath by Zandisiwe Radebe who identified herself as its co-founder and chairperson.

“As an organisation that was formed to advance, support and defend constitutional principles and values, BHK has an interest in the determination of the competing rights enumerated above.

“If admitted as amicus, BHK’s submissions will include a discussion on the following questions:

“Does the National Prosecuting Authority have a right or role to play (except for the role of the national director in terms of section 179(5)(d) of the Constitution and section 22(2)(c) of the National Prosecuting Authority Act (the NPA Act), and that of the director of public prosecutions in terms of section 13 of the NPA Act) where it has issued a certificate nolle prosequi?” Radebe said in her affidavit to be tabled before the Johannesburg high court on Thursday.

In the case between Ramaphosa and Zuma where the incumbent president wants to set aside summons for private prosecution issued by the latter, the NGO says it appears that the NPA has already taken a side.

“BHK will argue that the facts of this case demonstrate that the requirement of a certificate nolle prosequi may serve as an impediment or unjustified limitation to the Section 34 right of access to courts, especially when the National Prosecuting Authority as in this case appears to have nailed its colours to the mast of the accused person in the form and shape of the president.

“The National Prosecuting Authority has failed to conduct itself without fear, favour or prejudice. On the contrary, it appears to have taken the side of the president and this is a major factor (though not the only factor) that has moved BHK to intervene as amicus curiae,” she added.

The case between Ramaphosa and Zuma would be heard by a full Bench (three judges https://www.iol.co.za/the-star/news/full-bench-of-south-gauteng-high-court-to-hear-president-ramaphosas-interdict-application-against-former-head-of-state-zuma-ca321dfe-da53-48dd-a774-57845501acf3) on Thursday morning. https://www.iol.co.za/news/zuma-vs-ramaphosa-legal-battle-now-set-for-january-12-ef20338a-fd97-4810-b593-68831d105597

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127676

Originally posted at >>>/qresearch/18148890 (151546ZJAN23) Notable: Final Phala Phala & Ramophosa Bun / Zuma v Ramaphosa: NGO wants to join case as friend of court, targets NPA for alleged bias

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>127675

“Cyril Ramaphosa to know his fate next week after square off with Jacob Zuma in court”

https://www.iol.co.za/pretoria-news/news/cyril-ramaphosa-to-know-his-fate-next-week-after-square-off-with-jacob-zuma-in-court-b05f5108-4e28-43ac-9f80-af412feb0a4d

Published Jan 13, 2023

Pretoria - The country will have to wait until Monday before it knows if President Cyril Ramaphosa will be forced to appear before the Gauteng High Court, South Division, next week after judgment was reserved on whether he has succeeded in blocking a private prosecution.

Former president Jacob Zuma has instituted private prosecution proceedings against his successor, accusing him of being an “accessory after the fact”.

This after advocate Billy Downer SC and journalist Karyn Maughan allegedly leaked Zuma’s confidential medical information during his arms deal trial.

Yesterday, the president applied to the court to grant him an interdict that would prevent him from appearing on January 19 after receiving a summons from Zuma last year.

Ramaphosa also wants the court to declare Zuma’s private prosecution against him unconstitutional.

Part of the summons states that Ramaphosa should appear as an accused person in the matter against Downer and Maughan, saying that he did nothing about the matter.

In court, presided over by a full Bench composed of Gauteng Deputy Judge President (DJP) Roland Sutherland, Edwin Molahlehi and Marcus Senyatsi, Zuma was represented by advocate Dali Mpofu while Ramaphosa’s legal team was led by advocate Ngwako Maenetje.

Justice Sutherland said the Bench would deliver the judgment at 9.30am on Monday.

The courtroom was filled to capacity with journalists and friends of Zuma, including Jacob Zuma Foundation spokesperson Mzwanele Manyi and Dudu Myeni.

Carl Niehaus, who recently resigned from the ANC, was also there alongside Zuma’s daughter, Duduzile Zuma-Sambudla.

Also present was Zuma’s friend Louis Liebenberg, who is allegedly footing the bill for Zuma’s legal fees.

Speaking outside court, Manyi called for Ramaphosa to step aside.

“They keep dragging us into political stuff and we have been very careful as a foundation to comment on ANC things. In court they bring up the step-aside issue and say that the step-aside should be invoked.

“As is, the step-aside has not been invoked. This is all to run away from step-aside which he actually can’t. As from December 15 President Cyril Ramaphosa became a criminally charged person before the court.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127677

Originally posted at >>>/qresearch/18148902 (151549ZJAN23) Notable: Final Phala Phala & Ramophosa Bun / Zuma v Ramaphosa: NGO wants to join case as friend of court, targets NPA for alleged bias

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>127675

>A non-governmental organisation (NGO) calling itself Blackhouse Kollective Foundation (BHK) wants to be allowed to join Thursday’s legal battle between former president Jacob Zuma and President Cyril Ramaphosa as a friend of the court (amicus curiae).

>>127676

>Also present was Zuma’s friend Louis Liebenberg, who is allegedly footing the bill for Zuma’s legal fees.

It is interesting the spectrum of people supporting Zuma’s case – Louis Liebenberg and Blackhouse Kollective Foundation

“DA to take Louis Liebenberg to Equality Court over racist rant”

https://www.thesouthafrican.com/news/louis-liebenberg-da-equality-court-racist-voice-note-breaking-18-october/

“Who is Louis Liebenberg? Zuma’s new friend linked to ‘whites-only town’”

https://www.thesouthafrican.com/news/offbeat/breaking-who-is-louis-liebenberg-jacob-zuma-new-friend-pictured-whites-only/

“Who we are” – Blackhouse Kollective Foundation

https://blackhousekollective.org.za/

BlackHouse Kollective Foundation’s main Business activity is anti-racism activism

https://blackhousekollective.org.za/about/

Born out of a desperate need to once again scream black power from the disappointment that of the 1994 liberation project, the BlackHouse Kollective initiative calls upon all Black thinkers and prophets alike, to gather and recomplete the state of the Black Nation. We are called to break with the dominant logic of theorising about blackness from spaces that have so far served to maintain the intellectual negation if not erasure of black bodies that embody philosophical thought in white dominated spaces.

The BlackHouse Kollective wishes to establish itself as both an ideological home for black radical thought as advocated by both recognized and emerging black scholars in era characterised by the attacks against black thought both within and outside academia. We believe in an era over determined by callous anti blackness, we of black radical thought can no longer allow ourselves to be fragmented along superficial lines of ideological arrogance by the same powers the continue to perpetuate our suffering. The BlackHouse draws strength from the trajectory of black people’s search for true liberation and a desire to quench a thirst a 365 year old thirst for black liberation thought.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127678

Originally posted at >>>/qresearch/18148922 (151552ZJAN23) Notable: Eskom and Water Crisis Bun Part One / Eskom warns it could implement higher levels of power cuts – Higher than stage 6

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“Eskom warns it could implement higher levels of power cuts” – Higher than stage 6

https://www.iol.co.za/business-report/companies/eskom-warns-it-could-implement-higher-levels-of-power-cuts-4aee8041-2305-4c23-917a-5ba6c1df7a8e

SATURDAY, JANUARY 14, 2023

Eskom has warned that it could implement elevated levels of power cuts higher than stage 6 load shedding in a bid to safeguard the national grid if it experiences further multiple unplanned breakdowns.

This comes as the perpetually struggling power utility burnt through six million litres of diesel in one day on Wednesday when it ramped up load shedding to stage 6 indefinitely.

Eleven generators, amounting to 5 084MW of capacity, suffered breakdowns since Tuesday morning, leaving Eskom with 5 739MW on planned maintenance while breakdowns accounted for 18 041MW of lost capacity.

In email correspondence with Business Report yesterday, Eskom reiterated that the country would experience prolonged load shedding over the next few months as major capital projects and repairs reduce the available generation capacity.

The near collapse of the national grid due to unplanned breakdowns amidst the six-month outage of the 900MW Unit 1 at Koeberg Nuclear power station means that Eskom has to burn more diesel to keep the lights on.

Eskom was bailed out by an emergency lifeline supply of 50 million litres of diesel from PetroSA, which is expected to be used in crisis situations only until the end of March when the new financial year kicks in.

The number of days of load shedding per year has grown exponentially, from six days in 2018 to 22 days in 2019, 35 days in 202, 48 days in 2021, and 157 days in 2022. In 2023, load shedding is expected to be implemented for at least 200 days for the first time in history.

As the government prepares to rebuild investor confidence and mobilise investment at the World Economic Forum (WEF) in Davos next week, these crippling power cuts will be an albatross around the necks of the SA delegation.

Finance Minister Enoch Godongwana, during a pre-WEF breakfast meeting yesterday, said he would make an announcement in his Budget Speech next month regarding interventions to save Eskom.

https://www.iol.co.za/saturday-star/news/experts-call-for-ramaphosa-to-address-the-nation-over-load-shedding-and-power-hike-85390f0f-178b-4047-914d-8ce6fb49222f

Ramaphosa will be joining the WEF Annual Meeting in Switzerland, scheduled to take place in Davos next week.

Dr Garret Barnwell, a clinical psychologist and expert on climate change and mental health, warned of an increase in conflict, violence and mental health crises.

Already this week there was violence on the N4 highway in Emalahleni, in Mpumalanga, when angry residents torched several trucks and cars while protesting that they hadn’t had electricity for a week.

Ansara said Standard Bank CEO Sim Tshabalala’s recent suggestion that Eskom should consider an international candidate to succeed André de Ruyter would not change the way Eskom was structured.

“The problem is the whole structure around Eskom. You can have the best CEO in the world, but if the current way in which the utility is regulated remains in place, then you are not going to solve the fundamental problem. I think the crisis really is at an advanced stage.”

Minister of Mineral Resources and Energy Gwede Mantashe yesterday said that the energy crisis could be resolved in six to 12 months.

However Yelland said: “You have 90 generators that you cannot fix all at once, so you have to do it step by step over a long time. You have to have the spares, the money, plan it, and have the right people. In reality, this is not happening.

“But, oh well, talk is good now – let’s see the action.”

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127679

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18148929 (151554ZJAN23) Notable: Eskom and Water Crisis Bun Part One / “LEHOHLA: Eskom is headed for privatization (video)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“LEHOHLA: Eskom is headed for privatization” - https://youtu.be/zhaWQEXncic

Director of the Economic Modelling Academy, Dr Pali Lehohla says, Nersa's decision to grant Eskom an 18.65% electricity tariff hike will pit the poor against the rich considering the country's economic challenges. He says Eskom is headed for privatisation.

5:16 – “If the Russia-Ukraine war didn’t occur, the wool would be pulled over our eyes forever. This was a gift that showed the underlying reasons for closing fire powered coal stations. It’s about money and nothing else. It’s not about climate change or anything.”

“I don’t understand Ramaphosa’s load shedding apology, says former Statistician General Pali Lehohla”

https://www.iol.co.za/news/south-africa/i-dont-understand-ramaphosas-load-shedding-apology-says-former-statistician-general-pali-lehohla-75051738-df48-4736-a411-ce8262400b91

SATURDAY, JANUARY 14, 2023

Dr Pali Lehohla, former Statistician General of South Africa, told broadcaster Newzroom Afrika that there had been a trend of making State entities fail, setting them up for privatisation.

“The president [Cyril Ramaphosa] was in the war room. Financing for regular maintenance was withdrawn. You defund, make sure things don’t work, the people get angry, and then privatise it, sell it for a song. That’s what we are headed towards at the moment,” Lehohla said.

“So, I don’t understand the apology. I mean, the president has been there in the (Eskom) war room. He understands the importance of Eskom. But the decisions that they have taken, particularly in the period of trying to please the world with the just energy transition, were completely foolish.

Lehohla argued that closing the coal-fired power stations like Komati “was all about money, and not about the climate change or anything”.

He said there is an underlying agenda to make Eskom fail, like other State entities, and privatise it ultimately.

“Eskom was corporatised in 2001 or 2002, having performed as the best institution, getting credits higher than the sovereign itself, when it was not corporatised. What was the sickness in Eskom? There was no sickness. The sickness starts with corporatisation, and then subtle privatisation, then the issue of just energy comes,” said Lehohla.

Ramaphosa convened a National Energy Crisis Committee comprising ministers, and various technical workstream leads on December 15, 2022, demanding urgency and speed in the implementation of all priority areas and actions laid out in the National Energy Plan despite some of the progress that has been made.

“To date, Ramaphosa remains seized with finding a sustainable solution to the current energy crisis. The president has been regularly briefed on the situation at Eskom and on the roll out of the National Energy Plan.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127680

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18148934 (151554ZJAN23) Notable: Eskom and Water Crisis Bun Part One / Growing calls for government and Eskom to be sued for loadshedding (video)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“Growing calls for government and Eskom to be sued for loadshedding”

https://youtu.be/zttB3yARL_I

Jan 15, 2023

Many disgruntled citizens have taken to social media to vent their rage as loadshedding worsens with each passing day. Some South Africans from the legal fraternity, political organisations and civil society say they will challenge this matter in court. UDM president Bantu Holomisa says the court must rule on whether loadshedding is not a violation of human rights.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127681

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18155636 (161624ZJAN23) Notable: Final Phala Phala & Ramophosa Bun / Apartheid is over, don’t be afraid of white people, says Ramaphosa (video)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>127623

Making it a political affair… Let’s fuel 'racism' to continue to fight 'racism'.

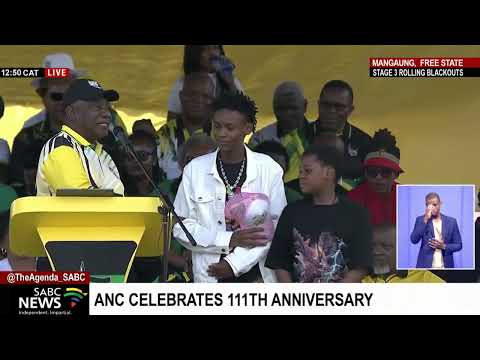

“ANC January 8 Statement | Ramaphosa speech at the ANC 111-year birthday celebrations” - https://youtu.be/u2KzMOj7m8Q [from about 11:40]

“Apartheid is over, don’t be afraid of white people, says Ramaphosa”

https://www.timeslive.co.za/politics/2023-01-08-apartheid-is-over-dont-be-afraid-of-white-people-says-ramaphosa/

08 January 2023 - 15:53

Apartheid is over, don’t be afraid of white people.

This was the strong message ANC president Cyril Ramaphosa sent to the Nakedi brothers who fought off racist attacks at a swimming pool in the Free State on Christmas day.

Ramaphosa hailed the Nakedi brothers for standing up to their attackers at the Maselspoort Resort saying their actions were courageous.

The two brothers, aged 15 and 18, were allegedly attacked by several older white men for swimming in a pool they claimed was only reserved for white people.

Ramaphosa invited the brothers as his special guests at the ANC’s 111th birthday celebrations in Mangaung.

He said the courage they showed in fighting back against such a shameful act was commendable as the time for racist white people was over.

“It was such a shameful act to see old white men trying to throttle these young men and to drown them in a pool under water, the most shameful act to perpetrate against young boys like these and that is why they are my guests,” Ramaphosa said.

“I thank you boys, stay strong and not be afraid of white people they no longer have power, their project of apartheid is over.”

Ramaphosa said there was no space for racists in South Africa and those who had not reformed must immediately vacate the country.

“We commend you, and say what happened to you should not deter you. You must be strong as young men, the message I want to give to you is that the spirit of our forebears who fought against the apartheid system must fill you with courage as it does all of us.

“But we also want to send clear message to those in our country who still want to perpetuate racism, and we say today we do not want racists here in South Africa.

“We honour these young men, we thank them and we also thank their parents for having stood firm to make sure that they resist the racist acts and practices being perpetrated against them.”

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127682

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18155647 (161625ZJAN23) Notable: Final Violence and Crime Bun / More high-profile names implicated on graft corruption at the National Lotteries Commission (video)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“More high-profile names implicated on graft corruption at the National Lotteries Commission”

https://youtu.be/nK_WsOUdc3g

Jan 15, 2023

The number of high-profile names implicated in lottery corruption continues to grow. Kwaito star and music producer, Arthur Mafokate, has now become embroiled in alleged lotto fraud and the SIU has frozen a property linked to him. It comes after it emerged that Terry Pheto who was the lead actress in the Oscar-winning film, Tsotsi, and another Tsotsi star, Presley Chweney-agae were being investigated for allegedly misappropriating funds distributed by the National Lotteries Commission. Money from lotto tickets was meant to be spent on good causes but it seems that many projects that were approved were linked to fake non-profit organisations who never did the work. They took money and some of it was also shared with senior officials from the Lotteries Commission who splurged on luxurious properties. GroundUp Investigative Journalist Raymond Joseph revealed transgressions for years and reported on projects that were never finished including an old age home, a drug rehabilitation centre and a sport stadium. He joins us now.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127683

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18155654 (161626ZJAN23) Notable: Updated Jacob Zuma Bun / Zuma foundation slams Ramaphosa interdict

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“Zuma foundation slams Ramaphosa interdict”

https://youtu.be/A8dg87seSxo

Jan 16, 2023

Jacob Zuma Foundation Spokesperson Mzwanele Manyi says President Cyril Ramaphosa remains charged despite the Johannesburg High Court granting Ramaphosa an urgent interdict against his predecessor Jacob Zuma's private prosecution. Newzrooms Afrika's Ziyanda Ngcobo reports

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127684

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18155740 (161639ZJAN23) Notable: Final Phala Phala & Ramophosa Bun / Ramaphosa’s plan for radical economic transformation and tackling unemployment (video)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>>/qresearch/18155726

>undo relations of exploitation through radical economic and social transformation

“Ramaphosa supports radical economic transformation”

https://youtu.be/8mrqqOHOXwU

Apr 20, 2017

Radical Economic Transformation is NOT a new term in South Africa. That's according to Deputy President Cyril Ramaphosa. He was addressing the Black Business Council in Johannesburg Wednesday night. The deputy president says to transform the economy, government must increase skills, get black professionals to work with government, create more black industrialists and develop SMME's

0:58 – “The economic transformation of our country… is non-negotiable. It has to happen and it is going to happen whether people like it or not. The economy has to be transformed and it will be transformed.”

“Ramaphosa’s plan for radical economic transformation and tackling unemployment”

https://businesstech.co.za/news/business/222155/ramaphosas-plan-for-radical-economic-transformation-and-tackling-unemployment/

31 January 2018

“As we found in Davos last week, many investors are prepared to work with us and our people to build our country,” Ramaphosa said.

Radical social and economic transformation

Ramaphosa said that a core part of this renewed focus on the labour market will be to “convince those who have not yet understood”, that it not possible to grow and sustain an economy that excludes black people – the majority of whom are African and female.

“Radical social and economic transformation is about creating a South Africa where all its citizens, black and white, share equitably in the country’s economy,” he said.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127685

Originally posted at >>>/qresearch/18157674 (162238ZJAN23) Notable: South African Navy Set To Welcome China And Russia; SA-China-Russia military exercise: Thandi Modise hits back at critics, says there was ‘no hype’ when US Army came

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

South African Navy Set To Welcome China And Russia

Bloomberg January 16, 2023

By Antony Sguazzin (Bloomberg) –South Africa will next month go ahead with naval exercises off its eastern coast with Russian and Chinese warships in a decision that could further strain its relationship with some of its biggest trading partners.

Operation Mosi, which means smoke, will take place from Feb. 17 to Feb. 26. South Africa’s reluctance to condemn Russia’s invasion of Ukraine and its decision to allow sanctioned Russian vessels to dock at its ports have already ramped up tensions with the US, UK and European Union who are backing Ukraine in the conflict. The country’s biggest opposition party questioned the wisdom of going ahead with the exercises.

“This gives the impression of not being neutral but being biased to one side. Clearly it can alienate us from other important trade partners, the west,” said Kobus Marais, the shadow defense minister for the Democratic Alliance. “This is in the best interests of Russia,” Marais said, calling it “another bad judgment, an embarrassment.”

While the exercise follows a similar event in 2019, it comes about a year after Russia invaded Ukraine, an event that brought into the open South Africa’s close ties with Russia due to historical support for the African country’s liberation struggle and their joint membership of the BRICS group of nations.

The US, Germany, Japan and the UK are leading trading partners for South Africa, while Russia isn’t in the top 15. Spokespeople from South Africa’s defense ministry and navy didn’t answer calls made to their phones or immediately reply to emails.

https://gcaptain.com/south-african-navy-set-to-welcome-china-and-russia/

[Three of the BRICS nations working together? Washington has to be freaked out]

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127686

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18167336 (181315ZJAN23) Notable: Konstantin Kisin: This House Believes Woke Culture Has Gone Too Far (video)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“Konstantin Kisin | This House Believes Woke Culture Has Gone Too Far - 7/8 | Oxford Union” - https://youtu.be/zJdqJu-6ZPo

“US and two foundation funds [Bezos Earth Fund and the Rockefeller Foundation] plan renewable energy credits for the developing nations”

https://www.iol.co.za/business-report/economy/us-and-two-foundation-funds-plan-renewable-energy-credits-for-the-developing-nations-b4b28ed2-4fbb-4cc7-a8d2-11cdf2fccccb

Published Jan 16, 2023

US climate envoy John Kerry on Sunday outlined core principles for a “high-integrity” carbon offset plan meant to help developing nations speed their energy transition, and next steps including establishing a consultative group.

The Energy Transition Accelerator (ETA), first announced at last year's COP27 climate conference, is being developed by the US with the Bezos Earth Fund and the Rockefeller Foundation to mobilise private capital.

Kerry told the Atlantic Council Global Energy Forum in Abu Dhabi the aim was to create bankable deals to accelerate reduction of emissions, stressing that the ETA was not a substitute for other funding sources and would be time-limited.

“We believe you can have high-integrity, accountable, transparent credit which will help us to be able to put some money on the table,” he said, acknowledging widespread criticism of voluntary carbon offset schemes.

Such schemes, in which companies get emissions credits in return for channelling cash to poor countries that cut their carbon output, have often been riddled with fraud and double-counting.

“There are only two purposes for which we will allow someone to be able to buy a credit - one, to be closing down or transitioning existing fossil fuel facility that is providing power, and two, for the actual deployment of renewables that will replace current dirty sourcing,” Kerry said.

He said ETA principles also called for a near-term, inclusive and comprehensive approach to deliver on broader sustainable development goals and support power sector-wide energy transition.

The Rockefeller Foundation on Sunday published a joint statement with a preliminary list of members of the ETA High-Level Consultative Group which Kerry said would provide a broad cross section of input and would add more participants.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127687

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18169949 (182129ZJAN23) Notable: Southern Africa troops face investigation over bodies video: Al Jazeera Newsfeed - Mozambique (video)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“Southern Africa troops face investigation over bodies video | Al Jazeera Newsfeed” - Mozambique

https://youtu.be/11Xoclko8qg

Jan 13, 2023

A regional force fighting armed groups in Mozambique says it’s investigating a video said to show its soldiers burning bodies.

”Probe launched after video shows soldiers throwing bodies onto pile of burning rubbish”

https://www.iol.co.za/news/africa/probe-launched-after-video-shows-soldiers-throwing-bodies-onto-pile-of-burning-rubbish-c1a81b11-e400-4987-8ac2-cbea9398c9be

Published Jan 10, 2023

The Southern African Development Community Mission in Mozambique (SAMIM) has launched an investigation following a viral video showing soldiers dumping bodies onto a pile of burning rubbish.

In the short clip, at least one man, dressed in SANDF uniform, can be seen looking on and filming the incident on cellphones.

The incident is believed to have taken place in November last year in Mozambique, where South Africa has committed forces as part of the SADC mission in Mozambique

In a short statement, the SANDF condemned the incident.

“The SANDF was recently made aware of a video clip circulating on social media depicting members in a yet unidentified defence force uniform throwing deceased bodies in a pile of burning rubble as well as the SANDF member(s) standing around watching them.”

SANDF spokesperson Brigadier General Andries Mokoena Mahapa explained that once the forces are committed, they form part of a combined force and fall under the command and control of SAMIM. South Africa only supports their mission logistically.

He said the force commander of SAMIM was conducting an investigation surrounding the involvement of its members in this despicable act.

“The SANDF does not condone in any way the acts committed in the video and those who are found guilty of such acts will be brought to book.”

The DA’s Kobus Marais said the contents of the video were unacceptable.

“This must be rejected in the strongest possible way. This is another embarrassment and an international blunder under the leadership of Minister Modise and President Ramaphosa,” he said.

Marais said while soldiers were deployed in Mozambique, they were still members of the SANDF.

“There are international standards and regulations for dealing with the bodies of the dead in a dignified and human way even in a conflict zone. Soldiers must adhere to their code of conduct and international standards and practices,” Marais said.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127688

Originally posted at >>>/qresearch/18170170 (182203ZJAN23) Notable: Final Julius Malema & Jacques Pauw Bun / Court dismisses Julius Malema’s bid to appeal AfriForum’s interdict which prohibits him from calling on land grabs

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“Court dismisses Julius Malema’s bid to appeal AfriForum’s interdict which prohibits him from calling on land grabs”

https://www.iol.co.za/news/crime-and-courts/court-dismisses-julius-malemas-bid-to-appeal-afriforums-interdict-which-prohibits-him-from-calling-on-land-grabs-23eebdc5-7c57-4c78-8d6c-bbf2b1f75265

WEDNESDAY, JANUARY 18, 2023

Pretoria – The North Gauteng High Court in Pretoria dismissed Julius Malema and the EFF’s application to appeal against an interdict which AfriForum acquired in 2017, which prohibited him and his party from calling on the public to invade and occupy any vacant land of their choosing.

Malema has been steadfast in his pursuit, calling on people to occupy vacant property however they wish.

In 2014 and 2016, he called on people to occupy vacant land, however, the National Prosecuting Authority instituted charges against him saying he violated section 18(2)(b) of the Riotous Assemblies Act.

Malema took offence to this, he petitioned the high court to declare that entire portion of the legislation illegal insofar as it demanded that someone found guilty of inciting others to commit a crime be punished with the same severity as the one who actually committed the crime.

In 2019, the high court ruled in favour of Malema, however, in 2020, the Constitutional Court overturned the ruling by the high court but found that only a particular section of the act was unconstitutional and invalid.

On Tuesday, Judge Peter Mabuse reinforced and relied on the ConCourt judgment which emphasised the unconstitutionality of incitement to trespass on private property.

“This judgment is a major win for private property rights and a big blow to those who wish to incite criminality, violence or lawlessness,” said AfroForum’s campaign officer for strategy and content, Ernst van Zyl.

“AfriForum welcomes Judge Mabuse’s judgment which adds the necessary emphasis on the serious criminal nature of inciting people to trespass on and illegally occupy private property,” Van Zyl said.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127689

Originally posted at >>>/qresearch/18170175 (182203ZJAN23) Notable: Final Julius Malema & Jacques Pauw Bun / Pay back the money: This is how much Julius Malema paid AfriForum

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“Pay back the money: This is how much Julius Malema paid AfriForum”

https://www.thesouthafrican.com/news/julius-malema-eff-pays-afriforum-thousands-in-legal-cost-18-january-2023/

18-01-2023

The Economic Freedom Front (EFF) and its President Julius Malema lost hundreds of thousands of rands over the years after they lost yet another legal battle against the civil rights group AfriForum with cost.

MALEMA, EFF LOSE THOUSANDS IN LEGAL BATTLES

In 2018 and 2019 Malema and the EFF paid Afriforum legal cost of R344 762.86 in total.

In the latest battle The Northern Gauteng High Court, Pretoria, dismissed Malema and the EFF’s a leave to appeal land invasion case and ordered them to pay AfriForum’s legal cost, on Tuesday 2023.

According to Van Zyl, Malema and the EFF was ordered to pay the civil rights group the sum of R102 092.30.

Since March 2017, AfriForum has obtained five cost orders against Malema and the EFF in five different appearances.

Van Zyl said they had applied these funds to some of AfriForum’s projects.

“We still have to decide what would be the best use of this new amount they have to pay. “We can assure our members and the public that it will go towards a good cause.”

Ernst van Zyl

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127690

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18170338 (182223ZJAN23) Notable: Updated Covid & Other Pestilence Bun / COVID-19 | Calls mount to halt vaccination drive (video)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“COVID-19 | Calls mount to halt vaccination drive”

https://youtu.be/Elu8caWGV38

Jan 18, 2023

#eNCA speaks to Shabnam Mohamed from Transformative Health Justice.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127691

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18174065 (191425ZJAN23) Notable: Eskom and Water Crisis Bun Part One / SA's electricity crisis: Millions of chickens culled (video)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

“SA's electricity crisis | Millions of chickens culled”

https://youtu.be/tRTs90sq7XE

“Chicken shortages loom as load shedding hits poultry industry hard”

https://www.iol.co.za/business-report/entrepreneurs/chicken-shortages-loom-as-load-shedding-hits-poultry-industry-hard-5deae152-2873-4b33-8496-a10483adc839

THURSDAY, JANUARY 19, 2023

Entrepreneurs who have invested and have directed their efforts into chicken farming are facing a crisis which could lead to a countrywide chicken shortage in the coming weeks.

According to a tweet by the South African Poultry Association, members have had to cull over 10 million 10-day-old chicks due to disruptions caused by constant disruptions caused by persistent load shedding.

This could directly impact poultry farmers' ability to meet the supply demands of the retail sector.

Speaking to the Citizen, Izaak Breitenbach, the general manager of the South African Poultry Association, pointed out that, ironically, there was no shortage of chickens. It was the backlog in the slaughtering of chickens causing the crisis.

“One can actually say there is no shortage of chickens. The chickens are standing on the farm, and we can’t get them through the slaughter process to get them to the restaurants and to get them to the retail. So that is really the issue we have.

“What has happened recently (is that) we had to cull more than 10 million day-old chicks because they have to go into houses that are still occupied by birds that should have been slaughtered.

“And because the load shedding is occurring every day with no respite, producers are just falling further and further behind,” he said.

Another adverse effect of the crisis was the increase in the price of chicken as a result of load shedding. Companies with generators could make up for production using generators.

While this may be a viable solution, there were costs involved. The diesel cost of slaughtering by using generators had an estimated impact of 75c/kg on chicken prices, and the only way for businesses to recoup these expenses was by charging the consumer more.

Former Johannesburg mayor and leader of political party Action SA, Herman Mashaba tweeted “When we start paying R300 plus for a chicken, at least we will know why.”

Attached to his tweet was a video depicting the disposal of a large number of chicken carcases.

Breitenbach, on behalf of the poultry industry, called on President Cyril Ramaphosa to intervene as a matter of urgency. He indicated if interventions were not undertaken to remedy the situation, it could have a negative impact on food security in terms of animal protein supply.

The potential shortages that threatened to affect the retail market had already impacted KFC last December.

Several franchises were temporarily closed, and menu items were limited in other stores as a result of limited stock supply when the country experienced stage 6 load shedding.

Disclaimer: this post and the subject matter and contents thereof - text, media, or otherwise - do not necessarily reflect the views of the 8kun administration.

b4517e No.127692

YouTube embed. Click thumbnail to play.

Originally posted at >>>/qresearch/18174169 (191503ZJAN23) Notable: Final ANC Bun / [ANC’s] RET faction joins hands with Carl Niehaus in new civil movement (video)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>>127504

>>127600

>>127601

“Carl Niehaus launches the Radical Economic Transformation Movement (RETMO)” [Jan 14, 2023] - https://youtu.be/Fd0fXLg9EPE

“[ANC’s] RET faction joins hands with Carl Niehaus in new civil movement”

https://www.iol.co.za/news/politics/ret-faction-joins-hands-with-carl-niehaus-in-new-civil-movement-b880cc1e-a6e4-4405-a250-76a0aa4f64d8

Published Jan 5, 2023

The [ANC’s] Radical Economic Transformation (RET) faction is throwing its weight behind Carl Niehaus's plans to establish a political movement.

Niehaus recently hinted at plans to establish his own movement following his expulsion and subsequent resignation from the ANC.

A member of the Radical Economic Transformation, Nkosentsha Shezi, declared the faction’s willingness to join hands with Niehaus.